|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

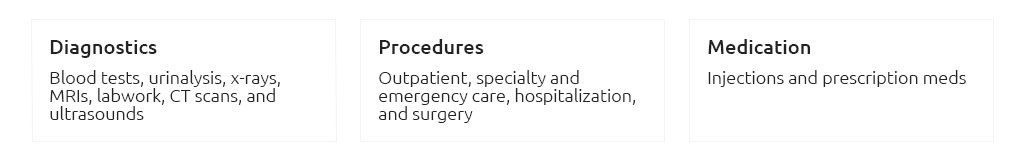

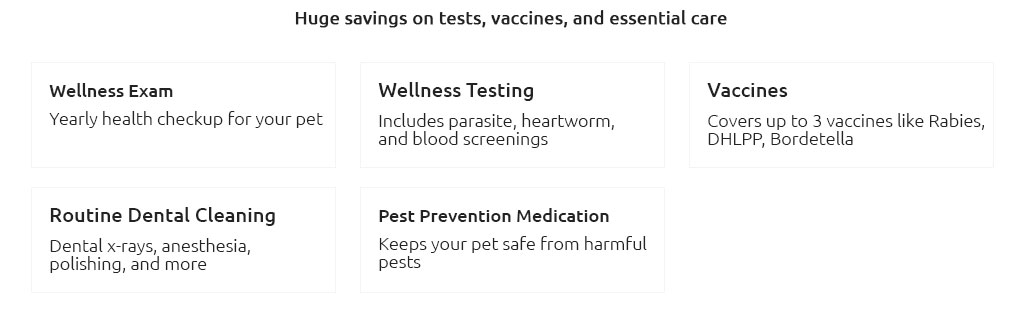

Understanding Insurance Companies for Pets: Expert Tips and AdvicePet insurance is becoming an essential consideration for pet owners who wish to protect their furry companions from unexpected medical expenses. With numerous companies offering various plans, it's vital to understand the key factors that influence your choice. What is Pet Insurance?Pet insurance is a type of coverage that helps mitigate the financial risk of veterinary expenses. It works similarly to health insurance for humans, covering a range of treatments, surgeries, and medications. Types of Coverage

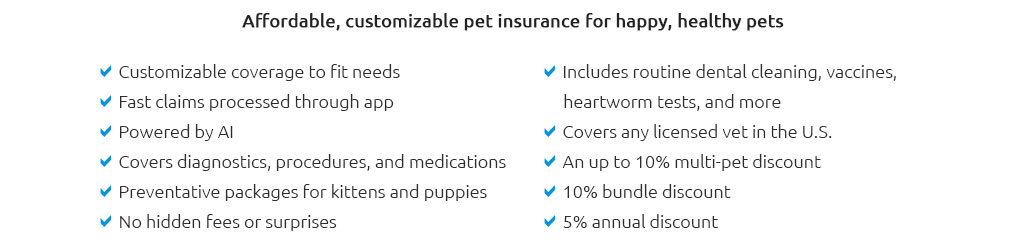

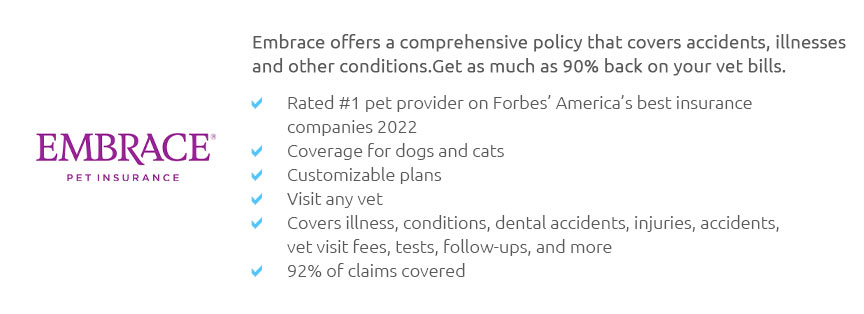

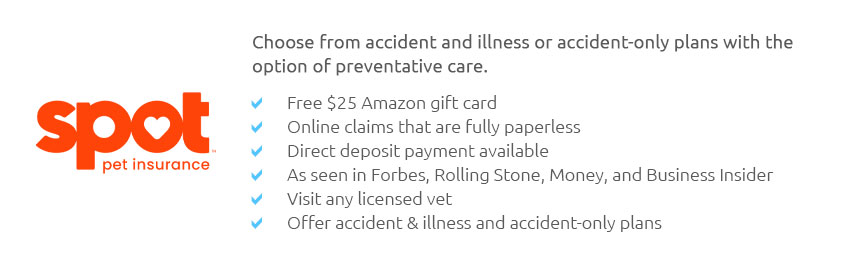

Choosing the Right ProviderWhen selecting an insurance company, consider factors such as coverage options, cost, and customer service. Researching different providers will help you find the best fit for your pet's needs. Top Factors to Consider

For pet owners with specific breeds, tailored insurance options may be beneficial. For example, if you are a Westie owner, you might consider exploring best pet insurance for westies for breed-specific needs. Common Claims and ReimbursementsUnderstanding how claims are processed can ease the reimbursement process. Most companies require you to pay the vet bill upfront and then submit a claim for reimbursement. Claim Processing

For Whippet owners, there are specific policies that cater to their needs, which you can explore further at best pet insurance for whippets. FAQs on Pet InsuranceWhat does pet insurance typically cover?Pet insurance generally covers accidents, illnesses, surgeries, and medications. However, coverage can vary widely between different providers and plans. Are pre-existing conditions covered by pet insurance?Most pet insurance policies do not cover pre-existing conditions. It is crucial to enroll your pet while they are healthy to avoid exclusions. How do deductibles work in pet insurance?Deductibles in pet insurance are the amount you pay out-of-pocket before the insurance company reimburses you. They can be annual or per-incident, depending on the policy. Is pet insurance worth it for older pets?While premiums may be higher for older pets, insurance can still be worthwhile to cover unexpected health issues that arise with age. https://www.akcpetinsurance.com/

Insurance products are underwritten by Independence American Insurance Company (NAIC #26581) or Independence Pet Insurance Company (NAIC #17543). Independence ... https://www.petinsurance.com/

Nationwide protects more than 1,000,000 pets - Pet insurance premiums starting at $13/mo.* - Visit any licensed veterinarian in the United States - Cancel at any ... https://www.embracepetinsurance.com/

Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness ...

|